LET ME HELP YOU FINANCE YOUR HOME!

I’LL SWEAT THE DETAILS SO YOU DON’T HAVE TO.

Purchasing a home is an important decision and you should be confident about your investment. I will work with you personally to offer you valuable insight throughout the process, save you time and find the mortgage that best suits your situation.

free consultation and prequalification

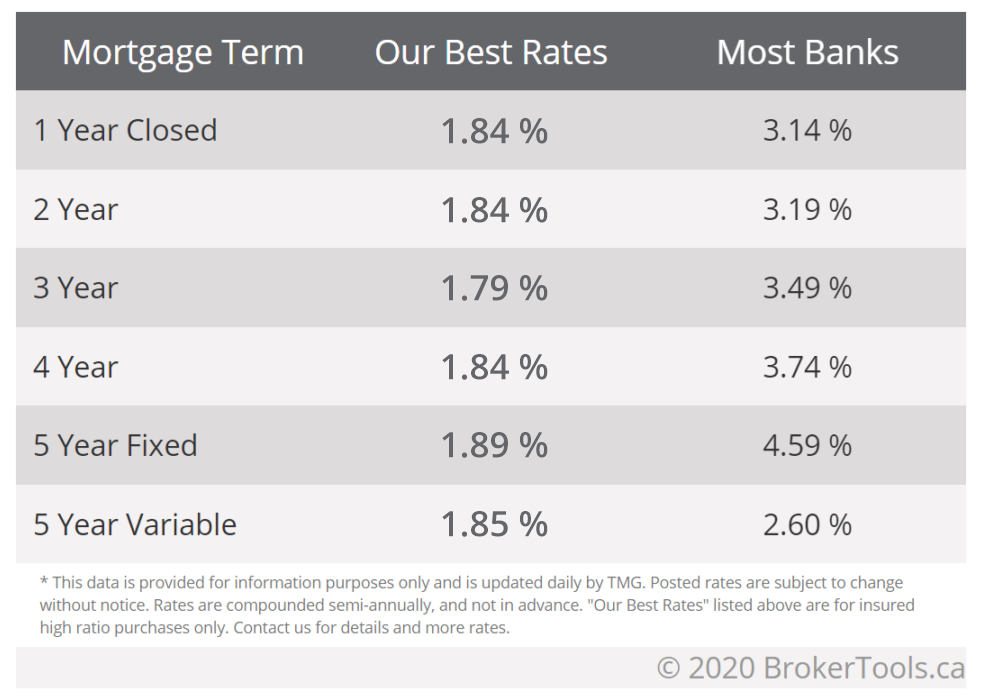

Our Mortgage Rates

EXPERTISE

I will provide you independent expert advice on your financial options. I am not tied to a specific lender or products so I can offer you mortgage products that will best match your specific needs.

SAVE YOU TIME WITH ONE-STOP SHOPPING

Instead of spending your valuable time meeting with competing mortgage lenders, I can quickly narrow down the list of lenders that will help you achieve your financial goals. I will make your comparison-shopping fast, easy, and convenient.

NO CHARGE TO YOU

There’s absolutely no charge for my services on typical residential mortgage transactions. Like many other professional services, such as insurance, mortgage brokers are paid a finder’s fee when we introduce dependable clients to a financial institution.

WHY SHOULD YOU USE MY SERVICES?

I will negotiate on your behalf. Many people are uncertain or uncomfortable negotiating mortgages directly with their bank. And even if you have an existing relationship with your branch, TMG does millions of dollars of transactions yearly with a wide variety of lending institutions so we have strong lender relationships. I can use that relationship to your advantage to negotiate your mortgage to ensure you secure competitive rates and terms that benefit you.

I will also ensure that you’re getting the best rates and terms. Even if you’ve already been pre-approved for a mortgage by your bank or another financial institution, you’re not obliged to stop shopping! I can investigate on your behalf to see if there is an alternative to better suit your needs.

Do you know about mortgage customization? All mortgages are not created equally, and depending on your financial goals, I will ensure the mortgage you receive helps you with those goals. Whether borrowing to purchase, renovate, or make your mortgage interest tax deductible, I can ensure that the mortgage you have helps achieve these financial goals.

What My Clients Say

Khider is one of the best Mortgage Brokers out there, hands down. He his helped me personally with my own finances as well as help my business almost double over a 2 year period. He took me under his wing and mentored me all while managing his busy work and family life.

As a start up business owner I reached out to Khider to secure a mortgage for a property was purchasing in Edmonton. Though I have impeccable credit most banks would not give me a mortgage as was only self employed less than 1 yr. Noy only did Khider get the deal approved but was able to put togeher an exceptional mortgage term and rate. By far the most trustworthy, friendly and customer oriented person I know. Very highly recommended.

I have found Mr. Khider Elkadri, a Mortgage Specialist from CMAC Mortgages, to be most helpful and informative on any mortgage issues I have had so far. His advice concerning my mortgage and the resale of my property was accurate, and he always responded to my queries in record time. I recommend him to anyone needing advice on Mortgage issues and looking for the lowest interest rates, especially if you are having a tough time dealing with and getting responses from local banks, and credit unions. I look forward to dealing with him for all my future mortgage needs.

FAQ

Why Use A Mortgage Agent?

- Power of professional negotiating expertise.

- One-stop convenience for access to numerous mortgage products.

- Unbiased knowledgeable advice.

- Access to unadvertised rates.

- Work for you, not the Bank

What is the Homebuyers Plan?

- The Home Buyers Plan is a federal government program that allows homebuyers to use $25,000.00 for each purchaser from his/her own RRSP.

- You must not have owned a principal residence within the last 5 years.

- You must intend to occupy your home as a principal residence.

- Minimum repayment is 15 equal annual installments. This schedule can be accelerated.

- The funds to be withdrawn must have been invested into the RRSP for a minimum of 90 days prior to withdrawal.

- You must complete a Form T1036.

Do I qualify for the 5% downpayment program?

- The home must be located in Canada and is to be occupied as your principal residence.

- You have from your own resources a down payment of at least 5% of the purchase price of the home.

- Your mortgage payment must not exceed 32% of your gross household income. This includes payment of principal + interest + property taxes + heat + condo fees (if applicable).

- You must be able to cover closing costs equivalent to at least 1.5% of the purchase price.

- You meet the lender’s eligibility requirements regarding income, employment and credit worthiness.

What should I expect for closing costs?

- Appraisal Fee: $200.00

- CMHC FEE (if applicable): $165.00

- Survey Certificate (if applicable): $250.00

- Home Inspection $250.00

- Legal Fees (approx): $750.00

- Tax Adjustment (if applicable)

- Interest Adjustment (if applicable)

- Property Transfer Tax (if applicable)

What is Property Transfer Tax and do I have to pay it?

- This tax is charged by the Provincial Government and is collected by your lawyer at closing.

- Each Province varies as to the amount but it is usually a percentage of the purchase price. For example in British Columbia, the amount the purchaser must pay is 1% of the first $200,000 and 2% of the balance.

- You are exempt from paying PTT in British Columbia if you have never owned a home anywhere. You must finance at least 70% of the purchase price and the maximum home price must not exceed $300,000.00.

What type of income proof do I have to provide?

In most situations lenders require a comfort level that the borrower has sufficient income and cash flow to service the mortgage as well as any other obligations that they may have. The higher the Loan to Value (ie mortgage amount vs. purchase price) the more important this becomes as the lender is placing less reliance on the value and equity in the property and more on the earning power of the borrower. The following is a summary of what Lenders require depending on what type of job you have:

Salaried Employees

- Job Letter – Lenders use 100% of the income. Verification is made on company letterhead, signed by appropriate individual. If you are a recent hire, the letter should confirm that probation period has been passed. Bonuses, car allowances and other forms of remuneration should be mentioned if applicable.

- Pay Stubs – Many Lenders will also require your most recent pay stubs.

Hourly Employees

- Pay Stubs – showing year-to-date income verification.

- T4’s and/or Personal Tax Returns (T1 Generals)- 3 years to take an average.

- Notice of Assessment – (NOA) – most recent to confirm no taxes owed.

Commission Income

- T4’s and/or Personal Tax Returns – 3 years to take an average.

- Job Letter – confirming position.

- Notice of Assessment (NOA) – optional depending on Lender.

Self-Employed

- Financial Statements of Company – 3 years average of net income used. Depending on Lenders policies, The add-back of various personal expenses run through the company may or may not be allowed (eg’s of allowable addbacks – Depreciation, Amortization, CCA (Capital Cost Allowance).

- NOA’s (Personal Notice of Assessments).

- Personal Tax Returns ( T1 Generals showing personal net income).

Overtime – Will be used as long as there is a proven track record – 3 years evidence (T-4’s).

Bonuses – Once again a 3 yr track record required.

Part-time Job – should be in place for a couple of years before using the additional income.

Tips – generally not recognized unless declared for tax purposes.

Car Allowances – This varies from lender to lender.

Alimony and Support – Evidence that payments have been made regularly and a copy of divorce agreement is required.

Investment Income – must be received continuously. This source of income is limited to interest, dividends or some type of ongoing revenue. Capital gains, which result from the liquidation of an asset is a 1 time occurrence and can’t be used.

THINK OUTSIDE THE BRANCH FOR YOUR MORTGAGE

NEW MORTGAGE

Need a new mortgage? I’ll help you pick the right fit for you and your budget.

RENEWAL

When it comes time to renew your mortgage, I’ll help you review your options and make the renewal process simple and easy.

REFINANCING

Sometimes, refinancing is your best option for a variety of reasons. Let me review your options and do the hard work for you!

I am part of TMG The Mortgage Group – an award-winning Canadian mortgage brokerage with a national team of over 800 qualified and accredited mortgage brokers, agents and associates providing residential and commercial mortgage services. Since 1990, TMG has helped over a quarter million Canadians get the best financing solutions and mortgage rates through Canadian mortgage lenders from coast to coast.

Contact Info

Khider Elkadri

Suite 120 2323 32 Avenue NE,

Calgary, AB

T2E6Z3

calgarymortgageshoppe.ca